Despite the uptick in interest rates in recent months, the economic news isn’t all bad.

House prices are still going up, albeit more slowly than last year, even as inventory begins to expand just a tad. And while the Fed has raised interest rates four times this year (and at least one more rate hike, if not two or three, is expected), interest rates on mortgages are still reasonable. Interest rates even took a slight dip last week — until big producers started reporting that they’re slowing production on pretty much everything, wood, furniture, merchandise, etc., hampering the ability of builders to construct homes and leaving warehouses packed with goods that people aren’t buying.

AEI’s Housing Center noted in a presentation this week that the amount of gas purchased by drivers in the last four weeks is down almost 14% year over year, despite year-over-year consumption being up in the first six months of the year. Housing Center chief Ed Pinto added that “non-necessity spending” is down across the all income levels year-on-year, and down most for the bottom 20 percent of income earners. Nonetheless, spending is up overall as essential items become more expensive.

Buying Less for More

Why are warehouses full, especially after all that talk about supply chain shortages? Wages aren’t increasing as quickly as inflation. This means consumers can’t buy as much as they used to because the cost of goods is rising faster than incomes. And when that happens, voilà, warehouses start to fill up with excess inventory.

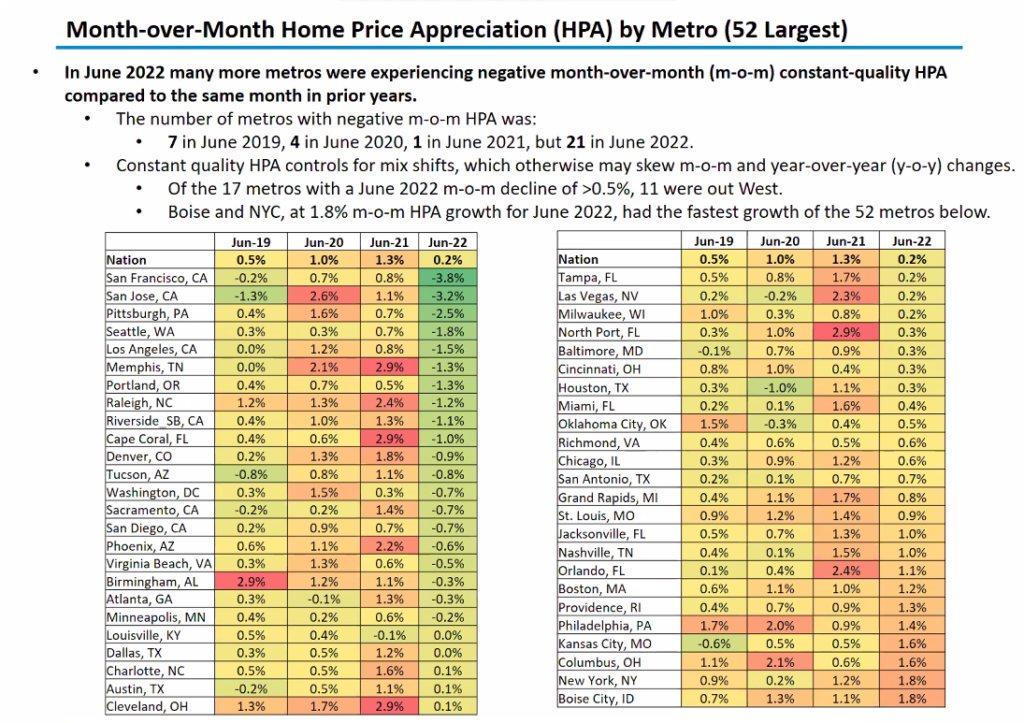

The crux of this monthly report reminds us what is common sense to most: the folks at the bottom are the first to feel the pain of a contracting economy. They also feel the pinch the most in tough economic times. Homeowners with FHA loans, those who generally have lower credit scores and less money to spend on down payments — and are considered higher risks for lenders, have recently increased their share of cash-out refinancing of their homes, which means more money in their pocket, but also more debt on their plate.

Normally, refinances occur to take advantage of lower rates, but with lower-priced homes appreciating the most right now, it’s not hard to imagine a homebuyer wanting to cash in on some of that equity. They put $10,000 in cash in their pocket from taking a cash-out refi on their house. Now their mortgage just went up by $10,000 — they owe more on the loan than you did before the refi. Their interest rate may not be as good as it was but they took the cash in hand because the cost of gas and electricity and food and baby formula all went up.

So now they have a bigger debt on your house; the amount of money they earn doesn’t pay for what it used to due to inflation; and they’re not saving the cash from the refi because they’re using it to cover bills. We know that’s true because the same reports shows that Americans’ savings are down and credit card spending is up.

Where does that leave the market? The most doom-and-gloom headline of AEI’s Housing Center report may be that the “stressed default rate” for FHA loans is now at 29.2 percent. That means that nearly three in 10 FHA home loans is at risk of defaulting. Why? Well, as we said earlier, FHA loans are used by those with lower credit, less cash in hand, and buying lower-priced homes, which are the properties currently appreciating in price by the largest percentages. But they just cashed out their equity. So when they run out of those extra funds, what happens then?

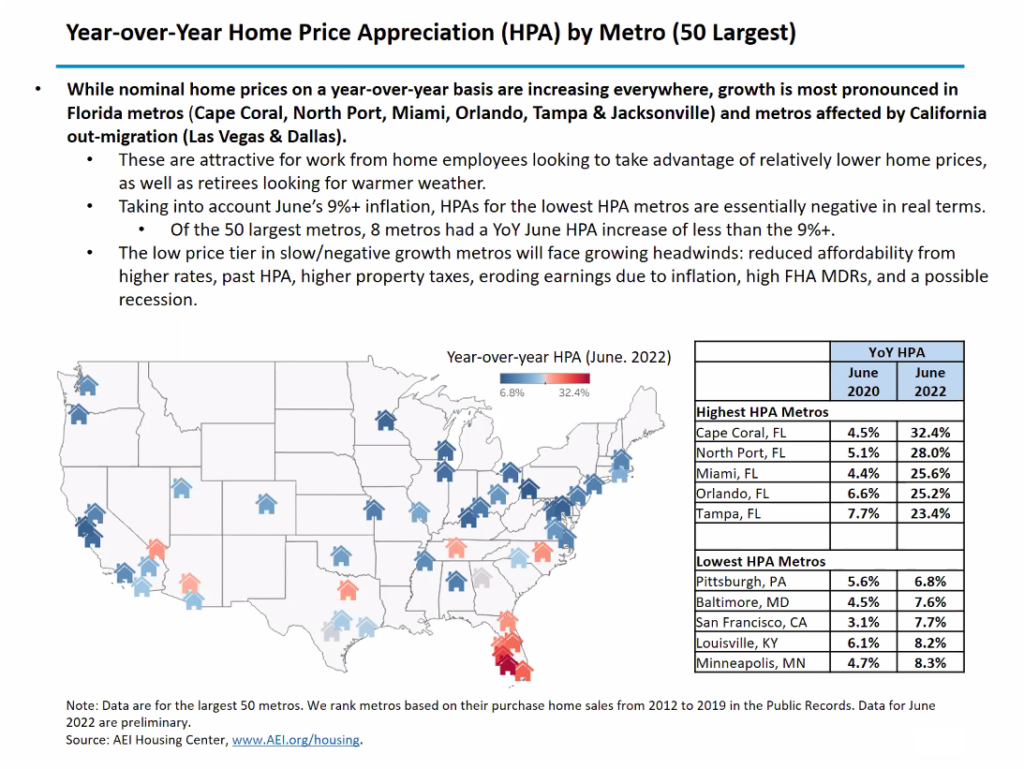

Baltimore Home Prices Are Reasonable By Comparison

It’s a discouraging vision, but it is not all bad news, at least not for folks around here. Baltimore is considered one of the most reasonably priced cities in the country, meaning home prices are not way more than they should be. Baltimoreans’ money goes further for home purchase than in many other cities. And they are more affordable.

As for middle income buyers who want more home for less, higher-priced homes are appreciating more slowly than lower priced homes. We see already in the most expensive cities in America, expensive homes are dropping in price. Locally, builders are going to feel the pressure to bring down their prices to bring in the middle income buyers, or they could build less extravagant homes, creating higher density in neighborhoods where large homes were once slated, which would create more housing. Both would reduce the upward pressure on pricing, which is what the Fed was aiming for when it raised interest rates to combat inflation.

While the rise in home prices may have slowed in Baltimore, year-on-year we can expect prices to have risen 4-6 percent, which means they are still in the positive territory. That gives sellers the opportunity to make the money they hoped they could get on the sale. At the same time, because of the reasonable rates in the area, Baltimore buyers are going to get a fair deal.

As always The Commodari Group welcomes your referrals. It is our mission to love, care for, and serve our clients in a way that gives them the best opportunity to fulfill their goal of buying or selling a home.