In the world of residential real estate, 2022 has been a weird year. Inventory to date is way down and the median number of days on market is just six. That’s right, six days! But that’s not what makes 2022 weird. The weirdness is that while the number of showings per buyer is off the charts, sellers are not getting as many offers on the table compared to 2021. The reason for this, I believe, is counterintuitive. It’s not because people are no longer interested in buying. Buyers may be leaving the market for a couple reasons: they could be frustrated with the buying process as a whole or the interest rates may have reduced their buying power to a point where buying is not as affordable as it was just five months ago.

Real Estate Buyer’s Agent Viewpoint

Plenty of buyers are still anxious to find a new home. But the decline in the number of offers may be due to exhaustion among real estate agents. For about two years now, agents have kept their eyes peeled on the multi-listing service in case a new home pops up for their buyers. They are running from showing to showing to make sure clients can see a property before it’s gone, and they’re writing offer after offer for their clients without getting a contract accepted.

Example of Real Estate Agent’s Changing Behavior

In one recent example, one of our agents had a property that went under contract in four days. She put the house on the market on a Friday and had 20+ showings in one weekend. But she only got a few offers, not the eight or nine she was expecting. Why? Agents called to question the interest in the home and backed out before even writing an offer down, knowing that the beautiful home she was selling was going to go under contract immediately and they could not compete. A few even called to ask her if they had a shot before bothering to put an offer in writing. Funny thing, the agent couldn’t tell them if they had a real chance unless they had an actual offer to present.

It’s frustrating, we know. Your clients see something that they like and get their hopes up, only to have them dashed by an offer that was 10-15 percent higher or had an “as is” clause (the buyer didn’t ask for a home inspection), or they are outbid by a competitor who is willing to waive the appraisal. It becomes discouraging to keep trying.

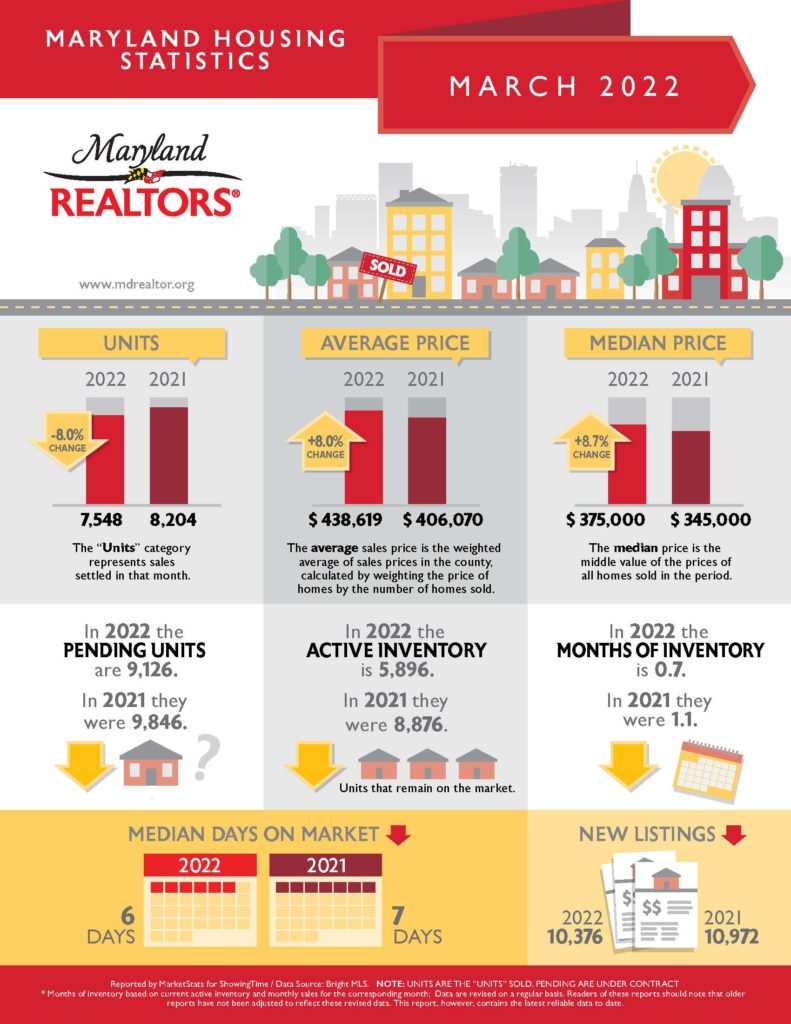

The Latest Monthly Housing Statistics

According to the Maryland Association of Realtors statistics, the average and median prices for homes In Maryland have risen in 2022 over 2021, meaning houses are being put on the market for more money and being bid up. And while a year ago, the market was hottest for upper end homes, the pain is especially acute right now for buyers in the $200,000-$350,000 range. The number of homes in this range is limited because these modest homes are being sold for more than the typical market would warrant. That raises prices for everyone. Yes, we’re happy for our seller clients that it is putting more money in their pockets, but it’s creating an inflationary trend that is pricing out of the market many first-time or lower-end homebuyers.

Interest Rates Affecting Home Buyers

With interest rates also rising due to overall inflationary economic conditions, how could this set of circumstances help buyers? It seems hopeless but it’s not. Here’s what I would tell a discouraged buyer right now:

- Yes, interest rates have about doubled since December but the cost of money is still incredibly low. 5-6% interest is not as impressive as a 2.75% rate but consider this: at 5% interest, for every $1,000 more you borrow, you’re going to pay $5 more each month for the loan. For every $10,000 more you borrow, that’s $50 a month. A lender can tell you really quickly whether you can afford that or not and you can decide whether you want to raise your ceiling on a search or bid.

- With interest rates on the rise, sellers may want to put their homes on the market because they are concerned that the well of potential buyers is going to dry up because buyers will be able to afford less. That’s going to bring more inventory into the stream, tamping down the inflationary trend.

- Rates are always changing and we may see a pull back this summer so don’t give up because you have to wait two more months for the home of your dreams. That’s the amount of time it takes to put you in a really good place to pay down your debts, get some money in the bank, and boost that credit score.

Home Buyer Tips

Home shoppers may feel like they’re never going to land in the place of their dreams. My advice is to stay focused on where you want to live and what kind of home you want. List your must-haves and your nice-to-haves and do the math for your monthly expenses. The market is always changing. Keeping your eyes on the prize and being clear about your needs will help you set goals that will pays off in the end.